The “Global Brewing Ingredients Market by Source (Malt Extract, Adjuncts/Grains, Hops, Beer Yeast, and Beer Additives), Brewery Size (Macro Brewery and Craft Brewery), Form (Dry and Liquid), and Region – Forecast to 2026” report has been added to ResearchAndMarkets.com’s.

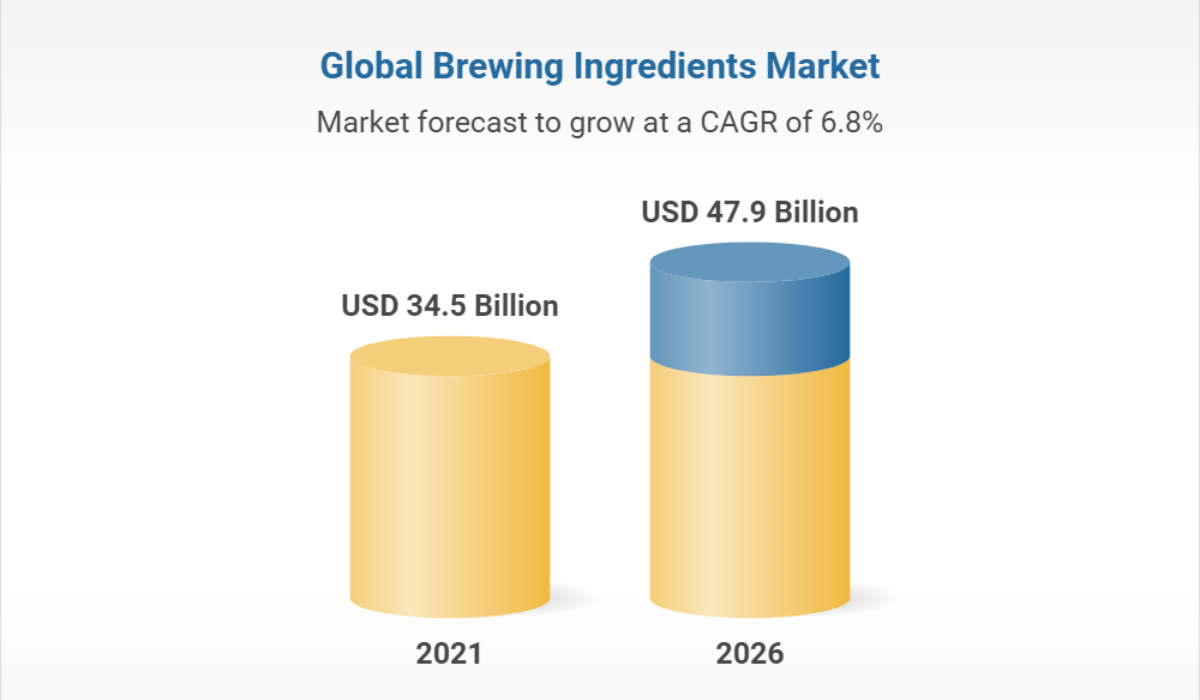

The brewing ingredients were placed at a value of USD 34.5 billion in 2021 and is projected to grow at a CAGR of 6.8%, to reach USD 47.9 billion by 2026.

This increase is mainly due to the rise in global population and increasing disposable income in developing economies which in turn, are creating new avenues for the spirit and beer world to take on.

According to the Brewers Association, the total value of the beer market was USD 94.1 billion in 2020, whereas the total craft beer market was estimated at USD 22.2 billion. The data provided by the Kirin Beer University Report shows that the global beer consumption stood at approximately 188.79 million kiloliters in 2018, up by 0.8% from the previous year, which is about 1,540,000 kiloliters, equivalent to approximately 2.4 billion 633 ml bottles. China remained the largest beer-consuming country in the

Research found that standard malt has enough enzymatic activity, notably diastatic power, to ensure that starch conversion occurs during mashing. It usually accounts for the largest percentage of malt in a beer recipe (anywhere from 60% to 100%).

The remaining percentage may be made up of specialty malts, unmalted grains, or adjuncts that may not have enough enzymes to convert their own starches to sugars during mashing. Brewing-grade malt extracts are made with the highest-quality brewing malts and get additional colors and flavors from using specialty malts. This gives beer the unique character and flavor desired for the particular style brew. These malts often have a longer time in the kiln, at higher temperatures, or get roasted to add depth, complexity, and flavor to the resulting beer.

Macro brew is a mass-produced beer brewed in very large quantities, due to which it is generally sold for a cheaper price than craft beer. Beers produced on a large scale in macro breweries are typically monotone in flavor and go through a standardized process of production, including filtration and pasteurization. According to the Brewers Association, an American craft brewer is a small and independent brewer, where small breweries have an annual production of 6 million barrels of beer or less.

The craft brewing industry contributed USD 82.9 billion to the US economy in 2019, with more than 580,000 employees. The average alcohol by volume (ABV) content of a craft beer is 5% to 10%, but some of the most popular craft beers have an ABV of as high as 40%. On the other hand, beer produced in bulk by macro breweries has an ABV of 4% to 6% and as little as 2%.

Craft breweries offer different flavors, which allow consumers with different tastes to cater to their preferences. These factors are driving the growth of the craft brewery segment in the global brewing ingredients market.

The Asia Pacific region is estimated to account for the largest share in the dairy beverage market. The demand for different beers with various flavors and different ABV is driven by economic growth, drinking culture in countries such as Vietnam and South Korea, urbanization, and the rise in the purchasing power of consumers.

The growth in the brewing ingredients market in the region is majorly driven by the following factors such as increasing population in several countries leading to the rising demand for different beers, urbanization and increase in disposable income, rising consumption of low- or zero-alcohol content beers, and increase in investments from leading players in beer and brewing ingredients markets.

Information for market research provided by businesswire.

Image courtesy of researchandmarkets.com