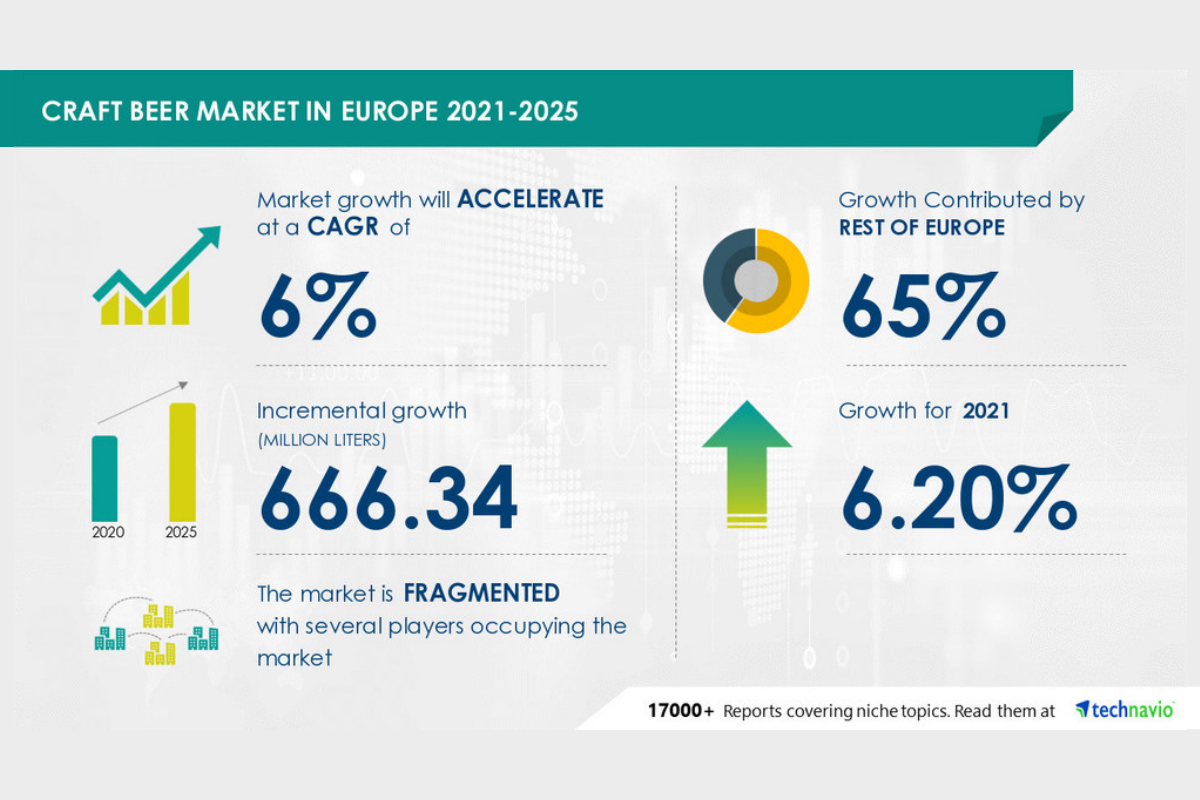

The craft beer market in Europe is expected to observe an incremental growth of 666.34 million liters between 2020 and 2025. The market witnessed a YOY growth of 6.20% in 2021 and the growth momentum is expected to accelerate at a CAGR of 6% during the forecast period. According to the report, the Rest of Europe (ROE) segment has the largest share of the market. The segment includes France, Italy, and other European countries. The increasing number of breweries, rising number of departmental stores selling do-it-yourself (DIY) homebrew kits, and growing number of beer tasting workshops in countries such as France are creating several opportunities for market players.

The craft beer market in Europe is fragmented due to the presence of many local and international players. The vendors operating in the market are focused on launching new and innovative products. They are also expanding their market share through partnerships and mergers and acquisitions. With constant innovations and the emergence of new breweries, the market is expected to witness high competition during the forecast period.

Technavio identifies Anheuser Busch InBev SA/NV, Asahi Group Holdings Ltd., BrewDog Plc, Buxton Brewery Co. Ltd., Cloudwater Brew Co., Diageo Plc, Duvel Moortgat NV, Heineken NV, Stone Brewing Co., and The Boston Beer Co. Inc. as dominant players in the market. Although the growing number of microbreweries and craft breweries, product launches, and growing demand for craft beer among millennials will offer immense growth opportunities, stringent regulations and heavy taxation, growing competition from other alcoholic beverages, and campaigns against alcohol consumption in Europe will challenge the growth of the market participants. To make the most of the opportunities, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The craft beer market in Europe is segmented as below:

- Product

- IPA-based Craft Beer

- Seasonal-based Craft Beer

- Pale Ale-based Craft Beer

- Amber Ale-based Craft Beer

- Others

The demand for Indian Pale Ale (IPA)-based craft beer has remained significant in the market. The distinct flavor of IPA is one of the key factors for the growing popularity of this variety of beer. In addition, the rising focus on innovating and experimenting with IPA-based craft beer by most breweries is expected to have a positive impact on the growth of the segment during the forecast period.

- Distribution Channel

- Off-trade

- On-trade

The off-trade distribution channel accounted for maximum sales of craft beer in Europe in 2021. The segment is driven by the cost advantages of off-trade distribution channels. They eliminate additional costs associated with seating. Besides, the proliferation of supermarkets and hypermarkets that offer various brands of craft beer will have an accelerating effect on the growth of the segment.

- Geography

- Germany

- UK

- Poland

- Russian Federation

- Rest of Europe (ROE)

The ROE segment will emerge as the key growth region, occupying 65% of the overall market share. The introduction of unique craft beer varieties in countries such as Italy is driving the growth of the segment. Besides, countries such as Germany, the UK, and Poland are expected to emerge as major markets for craft beer in Europe during the forecast period.

Technavio presents a detailed picture of the market by the way of study, synthesis, and summation of data from multiple sources. Our craft beer market in Europe report covers the following areas:

Craft Beer Market in Europe 2021-2025: Vendor Analysis

We provide a detailed analysis of around 25 vendors operating in the craft beer market in Europe, including some of the dominant vendors. Backed with competitive intelligence and benchmarking, our research report on the craft beer market in Europe is designed to provide entry support, customer profile, and M&As as well as go-to-market strategy support.

Craft Beer Market in Europe 2021-2025: Key Highlights

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will assist craft beer market growth during the next five years

- Estimation of the craft beer market size and its contribution to the parent market

- Predictions on upcoming trends and changes in consumer behavior

- The growth of the craft beer market in Europe

- Analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of craft beer market vendors

Understand the scope of the full report by Downloading a Sample PDF Report Here