A 4.7% increase in beer taxes in Canada is being opposed by labour unions and employees, who fear that beer prices may rise in the upcoming year.

The cost of beer will probably rise in April 2024 due to a 4.7% increase in federal beer excise levies.

According to Beer Canada’s president, CJ Hélie, a case of 24 beers might cost 20 cents extra.

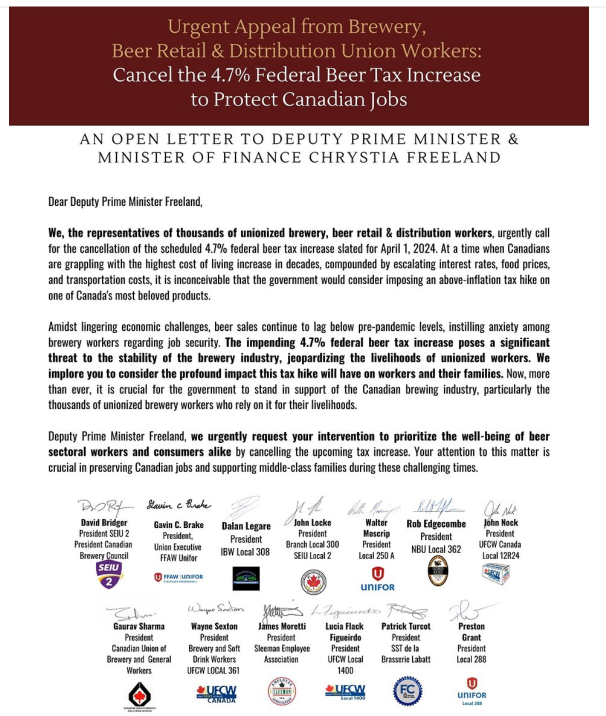

In an open letter to the honourable Chrystia Freeland, the minister of finance and deputy prime minister, Beer Canada, together with thirteen other prominent organized labour organizations representing the brewing industry from the brewery to distribution and retail, expressed their opposition to the tax increase.

In order to protect their employment and future prospects, the signatories—who represent beer workers from coast to coast—demand that the above-inflation beer tax rise be cancelled.

“At a time when Canadians are grappling with the highest cost of living increase in decades, compounded by escalating interest rates, food prices, and transportation costs, it is inconceivable that the government would consider imposing an above-inflation tax hike on one of Canada’s most beloved products,” the letter reads.

The letter points out that the tax poses a “threat” to the industry’s viability and imperils jobs.

An inflation-linked beer tax, according to Beer Canada’s press release, “adds fuel to inflation, puts upward pressure on interest rates and makes the Bank of Canada’s job to bring inflation back to its mid-range target of two per cent more difficult.”

As Canada now has the highest beer tariffs among the G7, Beer Canada claims that increasing beer taxes by over five percent would be detrimental to customers, employees throughout the beer’s added-value supply chain, and the hospitality and tourism industry.

SOURCE: Insauga

PHOTO CREDIT: Insauga