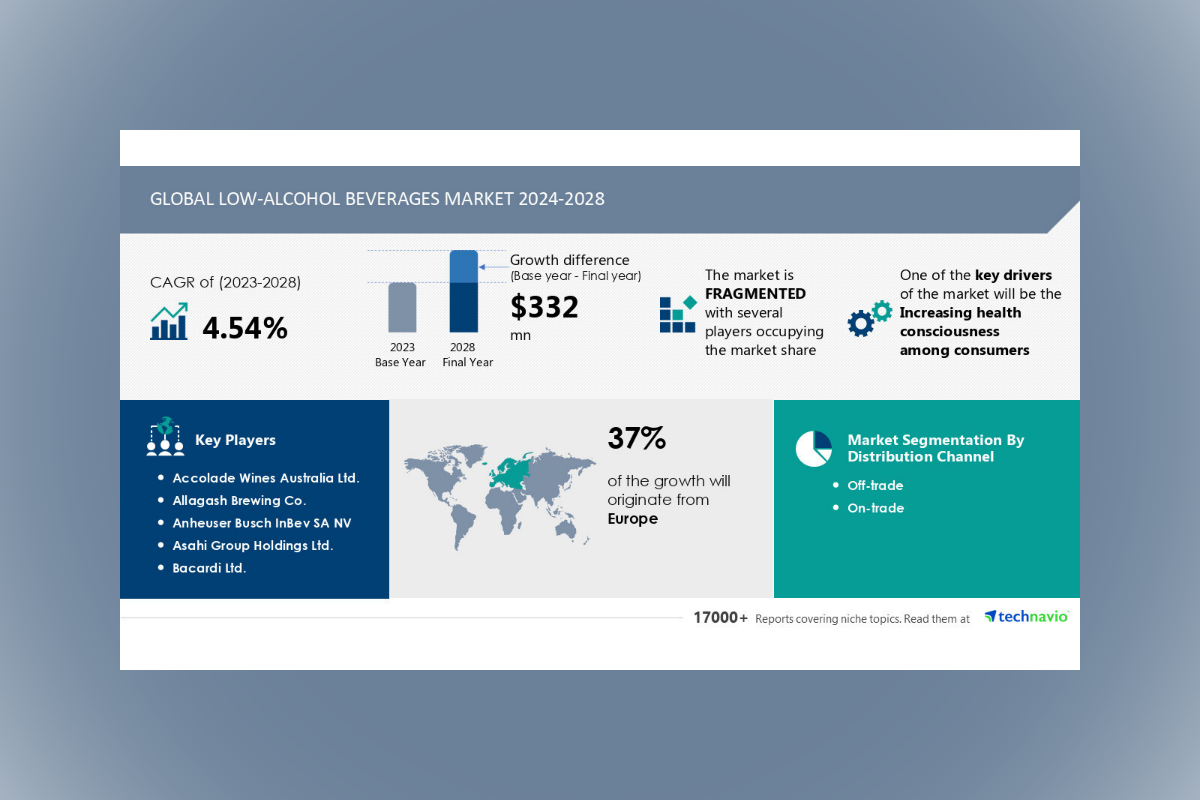

The global low-alcohol beverages market size is estimated to grow by USD 332 million from 2024-2028, according to Technavio. The market is estimated to grow at a CAGR of over 4.54% during the forecast period. Increasing health consciousness among consumers is driving market growth, with a trend towards increase in demand for gluten-free and low-calorie beer. However, availability of counterfeit products poses a challenge. Key market players include Accolade Wines Australia Ltd., Allagash Brewing Co., Anheuser Busch InBev SA NV, Asahi Group Holdings Ltd., Bacardi Ltd., Beam Suntory Inc., Carlsberg Breweries AS, CODYs Drinks International GmbH, Constellation Brands Inc., Curious Elixirs, Diageo Plc, Heineken NV, Kirin Holdings Co. Ltd., Metabrand Corp., Molson Coors Beverage Co., New Belgium Brewing Co. Inc., Olvi Plc, Royal Unibrew AS, Sapporo Holdings Ltd., and The Boston Beer Co. Inc..

Get a detailed analysis on regions, market segments, customer landscape, and companies — View the snapshot of this report

Market Driver

The global low-alcohol beverages market is experiencing significant growth due to increasing consumer preferences for gluten-free and low-calorie options. The demand for these products is driven by health and diet consciousness, as well as the rising number of people with celiac disease. In response, vendors in the market are introducing low-calorie and gluten-free low-alcohol beers. For instance, Good Drinks Australia Ltd launched Rider Lite, a no-carb, low-calorie beer brewed with electrolytes, containing 78 calories, and targeted at Gen Z and younger Millennial drinkers. The drink’s temperature-sensitive packaging adds to its appeal. The growing trend of low-calorie food and beverages, coupled with the increasing awareness of celiac disease, is expected to fuel market growth during the forecast period.

The Low-Alcohol Beverage market is on the rise, with a focus on healthy options and great taste. ABV in these beverages is kept low, making them attractive to health-conscious consumers. Taste and mouthfeel are key factors, ensuring these drinks don’t compromise on enjoyment. Variety is essential, with fruit flavors leading the charge. Companies like Molson Coors are entering this space with offerings like Coors Edge. Non-alcoholic beverages are also gaining popularity due to health concerns related to cardiovascular ailments and high blood pressure. Emerging economies and millennials are driving growth in the Low-Alcohol Beverage industry. Consumers, especially young people, are embracing healthy drinking habits and mindful consumption. The Low-Alcohol Beverage industry offers high-quality, creative, nutritious, and tasty alternatives to traditional alcoholic beverages. Cocktail mixes, canned drinks, and flavors like Cosmopolitan and Mojito are popular choices. Despite lower alcohol content, these beverages still deliver on taste and product quality. However, it’s important to note that even low-alcohol drinks can have negative health effects with heavy consumption.

Market Challenges

- The global low-alcohol beverages market faces a significant challenge from the prevalence of counterfeit products. With the increasing demand for alcoholic beverages, counterfeit manufacturers are capitalizing on the opportunity, particularly in developing regions. These products, made from low-quality raw materials, can lead to health risks. E-commerce platforms facilitate their distribution and sale, making it difficult for consumers to distinguish between genuine and counterfeit products. Government authorities worldwide seize counterfeit food and beverage products annually, including low-alcohol beverages. The illicit trade not only affects industry revenue but also poses a serious health threat to consumers. In India, between 2016 and 2022, over 6,000 people died due to spurious liquor. The relatively low price of counterfeit products impacts the sales and pricing strategies of genuine vendors, diluting their market shares and damaging brand reputation. Vendors attempt to increase consumer awareness through advertising and promotional campaigns. However, these activities are costly, reducing profit margins. Additionally, the availability of counterfeit products affects sales volume, leading to inventory backlogs for international vendors. Therefore, the presence of counterfeit low-alcohol beverages with lower prices remains a significant challenge for the global market during the forecast period.

- The Low-Alcohol Beverage Industry is witnessing growth as consumers, particularly millennials and young people, shift towards healthy drinking habits. This trend is driven by the desire for mindful drinking and better lifestyles. Low-alcohol beer, with its high-quality, creative flavors, is leading the charge. However, the industry faces challenges in meeting consumer preferences for taste and mouthfeel, as well as competitive alcoholic beverages like wine, beer, and spirits. To stand out, low-alcohol beverages offer nutritious options, with flavors ranging from Nolo drinks to cocktail mixes. Alcohol content is a key consideration, with many opting for cans and lower alcohol percentages. Negative health effects from heavy alcohol consumption continue to fuel demand. British craft beer and cocktails like Cosmopolitan and Mojito are also popular choices. Online shopping platforms provide low entry hurdles for businesses looking to enter this market. Overall, the low-alcohol beverage industry must focus on product quality, flavor, and meeting evolving consumer needs to succeed.

Research Analysis

Low-alcohol beverages, also known as alcoholic beverages with an Alcohol-by-volume (ABV) of less than 3.5%, are gaining popularity among consumers, particularly millennials and young people, who prioritize healthy drinking habits and mindful consumption. These beverages offer the taste and mouthfeel of traditional alcoholic drinks without the high calorie and alcohol content. The market for low-alcohol beverages is diverse, with a variety of options from fruit-flavored drinks to high-quality, creative brews. Consumers seek out low-calorie, nutritious options that align with their health goals. Product quality and flavor are key considerations, making it essential for manufacturers to prioritize these factors. Molson Coors, among others, has entered the market with offerings like Coors Edge, catering to this growing demand for tasty, low-ABV beverages.

Market Research Overview

The low-alcohol beverages market is witnessing significant growth due to the increasing demand for healthy and mindful drinking options. These beverages, with an Alcohol-by-volume (ABV) below 3.5%, offer consumers the taste and mouthfeel of traditional alcoholic beverages without the negative health effects associated with heavy consumption. With a focus on variety, quality, and low-calorie options, the industry caters to a wide range of customer preferences. Fruit flavors dominate the market, but creative low-alcohol beer and cocktail mixes are also gaining popularity. Emerging economies and millennials are driving the growth of this industry, with women and adults, in particular, showing a rising use of these beverages. The market includes a range of products, from non-alcoholic beverages to low-alcohol beer and wine, and even spirits. Despite the low alcohol content, product quality remains a key priority, with companies investing in innovative flavors and packaging, such as cans, to appeal to young consumers. Online shopping platforms and low entry hurdles further contribute to the market’s growth. However, negative health effects from alcoholic drink consumption continue to be a concern, leading to a greater emphasis on healthy drinking habits and better lifestyles.

SOURCE: PR Newswire / Technavio (Press Release)

PHOTO CREDIT: Technavio