All major categories except RTDs posted volume declines in January to July 2024 – but new monthly state-by-state IWSR analysis shows a more nuanced picture

The US beverage alcohol market continued to shrink in the first seven months of 2024, with volumes declining more than expected, according to new US data from IWSR.

IWSR’s newly launched product, US Navigator, tracks monthly beverage alcohol consumption by price tier across all US states, going back to 2019. Following the -2.6% decline in US total beverage alcohol (TBA) volumes recorded in 2023, IWSR forecasts had predicted a slight narrowing in 2024, with losses expected to moderate to -1.9%. However, TBA volumes fell by -2.8% in the first seven months of the year.

All major categories except RTDs (volumes +2%) shrank (January – July 2024), with beer volumes falling -3.5%, spirits down -3% and wine declining by -4%.

“Across the board, these declines are slightly worse than what was forecast at the start of the year,” notes Marten Lodewijks, President of IWSR’s US Division. “The slight recovery that was expected has failed to materialise, indicating that the difficult trading environment has not eased, and that consumers are still feeling the pinch of higher prices.

“Nonetheless, a successful second half of the year could still undo some of these losses – but it does make the job that much more difficult.”

These trends are also reflected in IWSR’s Bevtrac consumer data, with findings from the first half of 2024 suggesting that, although there has been an improvement in consumer sentiment and financial confidence – particularly amongst more affluent Millennials – this has so far failed to translate to overall increased consumption and spend, as consumers on lower incomes remain constrained.

However, a more nuanced picture emerges at the state level. For example, New York’s spirits volumes only fell by -1.5% in the January to July 2024 period (versus -3% for the US as a whole), whereas RTD and wine volumes witnessed above-average declines (-6.5% and -5% respectively).

“Our hypothesis here would be that New York’s strong cocktail culture and affluent urban base has helped to keep spirits relatively strong in this market, but at the expense of RTDs and wine,” says Lodewijks.

Other findings from the latest IWSR US Navigator data include:

Nuanced seven-month view by category and state

Beer’s nationwide volume fall of -3.5% is reflected in a fairly consistent picture across the US, with almost all markets in decline. Some, however, are posting smaller decreases, such as Florida, Texas and Pennsylvania, which all saw declines of less than -2%.

There are universal volume declines for spirits, but one or two brighter spots buck the overall trend. These include New York, Pennsylvania and North Carolina, which all also declined by less than -2% vs. the -3% national average.

RTDs are much more varied. While some states registered volume declines (Florida, New York and Michigan), others saw very robust growth, with standouts including Louisiana (+16%), South Dakota (+14%), Nebraska (+8%) and Minnesota (+6%).

The picture for wine remains consistently gloomy. Only New Mexico recorded a volume decline of less than -2%, and numerous markets shed more than 5% of their wine volumes between January and July, including Washington DC, Idaho, Kansas, Maryland and Oregon.

Seasonal Patterns

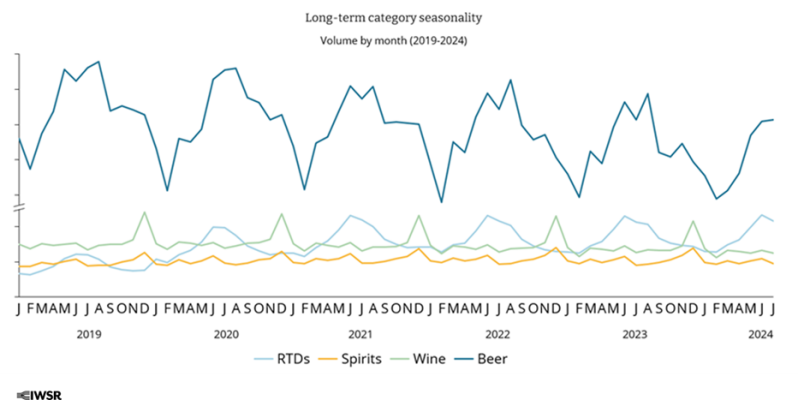

Category seasonality has remained largely unchanged since pre-pandemic, with RTDs and beer peaking in the summer months and wine and spirits peaking in December. RTDs typically peak 1-2 months before beer does, with RTDs reaching their apex in June while beer typically has its best months in July and August.

“This seasonality trend suggests that RTD consumers might be pivoting to beer over the hottest, peak summer months,” observes Lodewijks. “The other trend is the decline of all categories in January and February, but these troughs are getting consistently lower – a clear indication of growing moderation and the ongoing momentum of Dry January.”

Tequila softens, but premiumisation persists

Tequila volumes declined by -1% in January-July 2024, due to a fall in consumption of ultra-premium (-8%) and standard (-3%) products, partially offset by gains for super-premium (+4%) and premium (+6%). Prestige-and-above tequilas of over $100 also continue to grow at over +6%.

“The glow of tequila may have faded somewhat as consumers trade down to more affordable options, but the price mix change is an indicator that some premiumisation persists in the category and the continued strength of Prestige highlights how insulated these high price tiers are,” says Lodewijks.

Declines at the upper end of the market are also reflected by IWSR Bevtrac consumer research conducted in the first half of 2024, which indicated a fall in the highest price people were willing to pay for tequila versus the same period in 2023.

While the trends hold across major states, there is a strong contrast between California and New York, where premiumisation is resilient (super-premium +10% and +5%, respectively) and Florida and Texas, which show only small gains for super-premium, but double-digit growth for premium.

“This is most likely being driven by higher levels of disposable income in California and New York, alongside the fact that the category is still more of a novelty in the north-east compared to southern states, which are closer to Mexico, with much higher concentrations of Hispanic consumers,” comments Lodewijks.

American whiskey declines in core territories

American whiskey volumes declined by -2% despite the fact that numerous states were effectively flat, including New York, Pennsylvania, Tennessee, Kentucky and Colorado.

The category’s major losses, however, came from its bigger, core markets such as California, Florida, Michigan and Texas.

“Generally speaking, these states have larger premium price tiers and it’s been the softness here that has led to the decline,” notes Lodewijks. “Consumers seem less willing to trade up into this price tier, in contrast to states like New York and Colorado where premium growth is still robust”

IWSR Bevtrac consumer research from the first half of 2024 also indicates widespread downtrading across all whisky categories.

Spirit-based RTDs driving gains

Spirit-based RTDs now account for over 16% of category volumes in the US, following strong gains in January-July 2024. While RTDs overall were up by +2%, spirit-based products recorded gains of +11%, compared to flat performance for malt-based RTDs and a decline of -2% for wine-based alternatives.

“It is clear that the majority of the energy in the RTD category is coming from spirit-based variants now,” says Lodewijks. “However, there are still pockets of strong malt-based RTD growth, including Texas, Minnesota, Georgia and Pennsylvania.”

SOURCE: IWSR (Press Release)

PHOTO CREDIT: IWSR