Low and reduced alcohol beverages become gaining popularity in many regions with key factors such as rising health awareness, promotional strategies, perception towards non-alcoholic beverages and others.

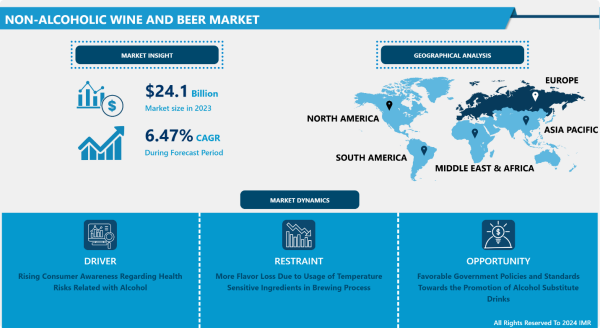

The global Non-Alcoholic Wine and Beer market is growing due to several factors such as Rising Consumer Awareness Regarding Health Risks Related to Alcohol.

Industry Overview

The global market for low and reduced-alcohol beverages has witnessed significant growth, fuelled by increasing health awareness and shifting consumer preferences. As people become more conscious of their health and wellness, the demand for beverages that offer the social experience of drinking without the negative effects of high alcohol content has surged. This trend is particularly evident in the rise of non-alcoholic and low-alcohol beers and wines. Consumers are drawn to these products as they provide the familiar taste and experience of alcoholic beverages while aligning with healthier lifestyles.

Light beers and reduced-alcohol wines have become particularly popular, with many brands introducing new product lines to cater to this growing demand. The market is expected to experience strong growth during the forecast period, with non-alcoholic wine and beer segments poised to benefit. The success of these products can be attributed to effective promotional strategies and a changing perception towards non-alcoholic beverages, which are no longer seen as inferior substitutes but rather as a conscious choice for those seeking moderation.

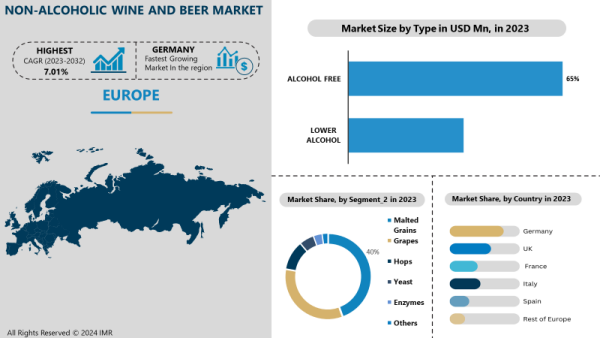

Germany, a country with a rich brewing tradition, plays a key role in the production of these beverages. The Reinheitsgebot, the country’s famous beer purity law, traditionally allows only four ingredients for beer production water, malted barley, hops, and yeast. In the modern brewing process, other grains such as wheat, rice, rye, oats, and maize have also been incorporated, along with non-traditional ingredients like sorghum, millet, and cassava. These ingredients allow for the development of various beer and wine-based products that appeal to diverse consumer tastes while maintaining low alcohol content.

In addition to Germany, many other regions worldwide have embraced innovative brewing technologies and processes to cater to this expanding market segment. The production of beers with light alcohol content is one of the fastest-growing segments within the global beer market. The non-alcoholic wine and beer market are positioned to continue its upward trajectory, driven by health-conscious consumers and evolving product offerings.

Rising Health Consciousness Among Consumers

The non-alcoholic wine and beer market is witnessing robust growth, primarily driven by rising health consciousness among consumers. As people become increasingly aware of the adverse effects of excessive alcohol consumption, including risks to liver health, cardiovascular issues, and impaired cognitive function, they are seeking healthier alternatives. This shift in consumer preferences is propelling the demand for low and non-alcoholic beverages, particularly among those who wish to enjoy the taste of wine and beer without the alcohol content. The market is experiencing heightened demand for these beverages, especially among health-conscious millennials.

Another key driver of this market growth is the increasing purchasing power of consumers, particularly in emerging markets. Millennials, in particular, are demonstrating a change in spending patterns, shifting from traditional alcoholic beverages to non-alcoholic options as part of a broader focus on wellness. This demographic is more willing to pay for premium products and more inclined to explore innovative and healthier alternatives. With rising disposable incomes globally, consumers can invest in higher-quality, alcohol-free wines and beers that provide a similar sensory experience to their alcoholic counterparts.

The market is also benefiting from significant investments in innovative technologies aimed at producing low-alcohol-by-volume (ABV) beverages. Leading companies are leveraging cutting-edge techniques, such as vacuum distillation and fermentation control, to create non-alcoholic beers and wines that closely replicate the flavor profiles of traditional alcoholic beverages. This technological advancement has been pivotal in improving product quality and consumer acceptance, driving the market forward.

The non-alcoholic wine and beer market is poised for further growth as social attitudes toward drinking evolve. More consumers are embracing moderation or abstaining from alcohol altogether, influenced by movements such as “sober curiosity.” This shift is expected to continue shaping the market over the coming years, with alcohol-free options becoming increasingly mainstream.

Growth Due to Supportive Government Policies

The non-alcoholic wine and beer market is experiencing substantial growth due to supportive government policies and evolving consumer preferences. The promotion of alcohol substitutes is gaining momentum with favourable regulations. For instance, branding products as “0% alcohol-free” provides a competitive edge, allowing producers to market their products as healthier alternatives. Moreover, in countries where non-alcoholic beverages are not subject to excise duty, like in Europe, this cost advantage directly boosts market growth by lowering prices for consumers, enhancing affordability, and stimulating demand.

Another driving force behind the market expansion is the growing convenience of home delivery services. With the rise of online food delivery platforms, consumers are increasingly opting to purchase non-alcoholic beer and wine from the comfort of their homes. This shift in purchasing behaviour opens up significant opportunities for companies to reach a broader audience, catering to the needs of health-conscious consumers who prefer convenient, on-demand services. The integration of alcohol-free drinks into these platforms enhances their availability, contributing to market penetration.

The global trend toward healthier lifestyles and reduced alcohol consumption plays a crucial role in fueling demand for non-alcoholic beverages. As consumers become more aware of the health risks associated with alcohol, many are turning to alcohol-free alternatives that offer similar taste experiences without the negative effects. This trend creates a favourable environment for key players in the market to innovate and introduce new flavours and premium products that appeal to a wider demographic, including younger, health-conscious consumers.

Increasing awareness of drink-driving laws and the promotion of sober lifestyles are further expanding the market’s potential. Governments and advocacy groups worldwide are actively promoting the benefits of non-alcoholic drinks as safer alternatives. This supportive environment provides a fertile ground for market growth, offering existing players a unique opportunity to tap into a growing consumer base that prioritizes health and safety.

Flavor Loss Due to Temperature-Sensitive Ingredients

One of the primary challenges hindering the growth of the non-alcoholic wine and beer market during the forecast period is the significant loss of flavor caused by the use of temperature-sensitive ingredients in the brewing process. The production of non-alcoholic beverages typically involves de-alcoholization, which requires the application of high-temperature processes to remove the alcohol content. Unfortunately, many ingredients used in brewing are sensitive to these elevated temperatures, leading to a noticeable loss in flavor and aroma, which are critical to the overall consumer experience.

The flavor loss can reduce the appeal of non-alcoholic beverages to consumers, who seek an authentic taste similar to their alcoholic counterparts. The use of high temperatures disrupts the delicate balance of ingredients that contribute to the complex flavor profile of wines and beers, affecting their quality. Manufacturers face a dilemma in balancing effective de-alcoholization while maintaining the product’s desired sensory qualities.

This issue is exacerbated by consumer expectations for high-quality non-alcoholic beverages. As the demand for healthier, alcohol-free options rises, consumers are less willing to compromise on taste. Therefore, manufacturers are compelled to find innovative methods that can maintain the full flavor without sacrificing the efficiency of the production process. Such technological advancements require significant investment, which might not be feasible for smaller producers, further limiting market growth.

The flavor degradation caused by high-temperature processes is a key restraint in the non-alcoholic wine and beer market. Manufacturers must prioritize addressing this challenge, either through innovation in low-temperature de-alcoholization or by incorporating more heat-stable ingredients, to meet the growing demand for high-quality, flavorful non-alcoholic beverages while driving market growth.

Key Manufacturers

- Big Drop Brewing

- Carlsberg

- Bernard Brewery

- Erdinger Weibbrau

- Suntory Beer

- Anheuser-Bush InBev

- Moscow Brewing Company

- Heineken N.V.

- Behnoush Iran

- Pierre Chavin

Recent Industry Development

In July 2023, Anheuser-Busch InBev (AB InBev) invested €31 million to upgrade technology at its breweries in Belgium, focusing on boosting non-alcoholic beer production and enhancing bottling capabilities. The investment underscored the company’s dedication to innovation and addressing growing consumer demand for non-alcoholic beverages. The upgrades included modernized equipment to improve efficiency and sustainability in production processes. This strategic move aligned with AB InBev’s broader efforts to diversify its product offerings and stay ahead in a rapidly changing market, reflecting its commitment to meet evolving consumer preferences.

In May 2023, Heineken NV announced it invested 1.5 billion reais ($300.8 million) in Brazil to expand its premium and single malt beer portfolios. The investment aimed to strengthen Heineken’s presence in the country by enhancing its production capacity and focusing on high-demand premium products. This move reinforced Heineken’s commitment to Brazil as a key growth market. The expansion aligned with the company’s broader strategy to tap into the increasing consumer preference for premium beverages. Heineken continued to lead innovation and growth in the Brazilian beer industry through this significant investment.

Key Segments of Market Report

By type, Alcohol-Free is dominating the market during the forecast period

The non-alcoholic wine and beer market has experienced significant growth, driven by changing consumer preferences towards healthier lifestyle choices and the increasing demand for alcohol-free options. This surge is primarily attributed to millennials and health-conscious consumers who seek alternatives that provide the social experience of drinking without the negative effects of alcohol. As more consumers prioritize wellness, brands are innovating to create flavors and experiences that closely mimic traditional alcoholic beverages.

The market is witnessing a rise in product diversification, with a variety of flavors, styles, and packaging options available to cater to diverse consumer tastes. Major players such as Heineken, BrewDog, and Athletic Brewing Company have introduced their non-alcoholic beer lines, which appeal to sober consumers and attract those looking to reduce their alcohol intake. The wine segment is equally thriving, with companies like Freixenet and Torres expanding their portfolios to include premium alcohol-free wines that appeal to connoisseurs. This diversification, coupled with strategic marketing and collaborations, is enhancing the visibility and acceptance of non-alcoholic beverages in mainstream channels, including restaurants and bars.

Advancements in brewing and fermentation technologies have allowed manufacturers to produce high-quality non-alcoholic alternatives that maintain the rich flavors of traditional products. Innovations such as vacuum distillation and reverse osmosis are becoming commonplace, enabling brands to offer a broader range of non-alcoholic wines and beers that do not compromise on taste or aroma. As consumers continue to shift towards healthier drinking habits, the non-alcoholic wine and beer market is poised for sustained growth, positioning itself as a dominant segment within the broader beverage industry.

By Technology, the Restricted Fermentation segment held the largest share in 2023

The non-alcoholic wine and beer market has experienced significant growth in recent years, driven by increasing consumer awareness regarding health and wellness. This shift in consumer preferences has led to a surge in demand for non-alcoholic beverages, particularly among those seeking to reduce alcohol intake without sacrificing taste or social experiences. The market has seen innovative developments, especially in the restricted fermentation segment, which has emerged as a key contributor to this growth. This technology allows for the production of non-alcoholic beverages that retain the flavor profile of traditional wines and beers while keeping the alcohol content below 0.5% ABV.

In 2023, the restricted fermentation segment held the largest share of the non-alcoholic wine and beer market, accounting for a substantial portion of total sales. This segment’s popularity can be attributed to the advanced brewing and fermentation techniques that create rich, full-bodied beverages that appeal to consumers’ taste preferences. Brands have invested in research and development to enhance the sensory qualities of their products, making them more attractive to consumers who may have previously shied away from non-alcoholic options. Consequently, this innovation has not only expanded product offerings but has also driven market penetration in both retail and hospitality sectors.

The non-alcoholic wine and beer market is witnessing robust growth across various regions, particularly in North America and Europe, where lifestyle changes and regulatory support have encouraged the consumption of non-alcoholic alternatives. The rising trend of mindful drinking, along with a growing number of craft breweries and wineries entering the non-alcoholic space, is expected to further fuel market expansion. As consumers increasingly prioritize health-conscious choices, the non-alcoholic wine and beer market is poised for continued growth, with projections indicating that it will maintain its upward trajectory in the coming years.

Europe is Expected to Dominate the Market Over the Forecast Period

The nonalcoholic wine and beer market is experiencing significant growth, particularly in the Europe region, where Germany stands out as one of the largest markets globally for low-alcoholic beverages. Factors driving this growth include changing consumer preferences toward healthier options, well-established distribution channels, and the presence of numerous key players offering a wide variety of products. As consumers increasingly seek alternatives to traditional alcoholic beverages, the market is poised for continued expansion during the forecast period, with diverse offerings catering to a range of tastes and preferences.

North America is also witnessing substantial market growth, fueled by rapid advancements in research and development activities. The region is characterized by consistent innovation in nonalcoholic and low-alcohol beer products, which resonate with changing consumer preferences for healthier lifestyle choices. This trend is further amplified by the increasing availability of nonalcoholic options in retail outlets, making it easier for consumers to access and experiment with these beverages. The North American market is expected to experience robust growth throughout the projected period, driven by the rising demand for healthier beverage choices.

In the Asia Pacific region, China leads the demand for alcohol-free beer and wine, reflecting a growing trend toward health consciousness among consumers. Countries such as India, Japan, and China are witnessing increased popularity for nonalcoholic options, partly due to rising health awareness and cultural shifts in beverage consumption. There is a significant demand for alcohol-free products in Muslim countries, where the need for compliant beverage alternatives is on the rise. In Latin America and the Middle East, growing awareness of health benefits associated with nonalcoholic beverages, coupled with increasing populations and spending on such products, is contributing to market growth, which is expected to continue in the coming years.

SOURCE: GlobeNewswire / Introspective Market Research (Press Release)

PHOTOS CREDIT: Introspective Market Research