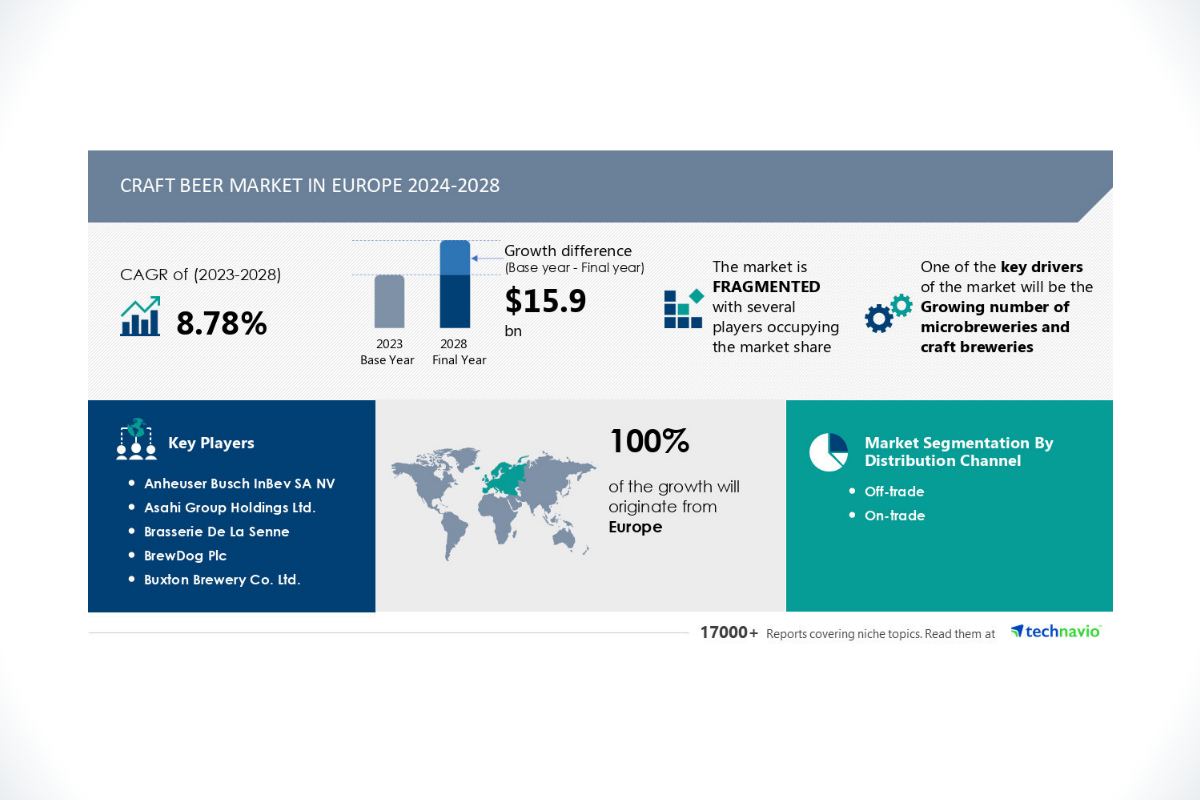

Report on how AI is driving market transformation – The Global Craft Beer Market in Europe size is estimated to grow by USD 15.9 billion from 2024-2028, according to Technavio. The market is estimated to grow at a CAGR of 8.78% during the forecast period. Growing number of microbreweries and craft breweries is driving market growth, with a trend towards increasing number of partnerships, agreements, and M and A activities. However, stringent regulations and heavy taxation for alcoholic beverages poses a challenge – Key market players include Anheuser Busch InBev SA NV, Asahi Group Holdings Ltd., Brasserie De La Senne, BrewDog Plc, Buxton Brewery Co. Ltd., Carlsberg Breweries AS, Cloudwater Brew Co., Diageo Plc, Duvel Moortgat NV, German Kraft Brewery Ltd, Heineken NV, Lervig AS, Magic Rock Brewing Co. Ltd., Mikkeller APS, Stone Brewing Co. LLC, Swinkels Family Brewers, The Boston Beer Co. Inc., Thornbridge Brewery, VAN PUR S.A., and Wild Beer Co..

Craft Beer Market In Europe Scope | |

Report Coverage | Details |

Base year | 2023 |

Historic period | 2018 – 2022 |

Forecast period | 2024-2028 |

Growth momentum & CAGR | Accelerate at a CAGR of 8.78% |

Market growth 2024-2028 | USD 15.9 billion |

Market structure | Fragmented |

YoY growth 2022-2023 (%) | 7.57 |

Regional analysis | Europe |

Performing market contribution | Europe at 100% |

Key countries | Germany, UK, Poland, Russia, and Rest of Europe |

Key companies profiled | Anheuser Busch InBev SA NV, Asahi Group Holdings Ltd., Brasserie De La Senne, BrewDog Plc, Buxton Brewery Co. Ltd., Carlsberg Breweries AS, Cloudwater Brew Co., Diageo Plc, Duvel Moortgat NV, German Kraft Brewery Ltd, Heineken NV, Lervig AS, Magic Rock Brewing Co. Ltd., Mikkeller APS, Stone Brewing Co. LLC, Swinkels Family Brewers, The Boston Beer Co. Inc., Thornbridge Brewery, VAN PUR S.A., and Wild Beer Co. |

Market Driver

The European craft beer market is experiencing a significant trend of mergers and acquisitions (M&A) among vendors. This activity is beneficial as it allows vendors to expand their market shares, gain access to new products and technologies, and enhance their product portfolios. The popularity of craft beer has motivated larger players to acquire smaller specialists in this category. Furthermore, partnerships with regional macro breweries and distributors enable key players to enter new markets and offer innovative products. These M&A activities are expected to boost the market by enabling vendors to provide a diverse range of craft beer offerings, thereby driving growth during the forecast period.

The Craft Beer Industry in Europe is thriving, with a focus on Microbreweries and Independent Breweries producing unique, flavorful options. Consumer preferences shift towards Low Alcohol Beverages and No Alcohol Beers, catering to Health Conscious Consumers. Beer styles like Craft Lager, Ale, and Stouts remain popular. Urbanization drives the demand for premium products, including Craft Ale and innovative flavors like CBD infused beers. Millennials and Gen Z favor local events and social media engagement. Beer quality is key, with advanced brewing technologies used for Alcoholic Craft Beverages and Distillation Techniques. Health benefits and Organic Flavors are trending. Off trade channels, such as Convenience Stores, and On trade, like Brewpubs, offer diverse options. Despite the focus on health, Alcohol Tolerance remains a factor, with Light Lager and Premium Products catering to different segments. Retail Shops and E-commerce platforms make it convenient for consumers to access their preferred Alcoholic Beverages.

Market Challenges

- The European craft beer market is subject to rigorous regulations and taxation policies. Vendors must adhere to various sectoral laws and regulations regarding ingredients and labeling, enforced by European Union (EU) and other authorities. For instance, the Food Information to Consumers (FIC) regulation 1169/2011 mandates the mention of allergens on consumer labels, including cereals containing gluten. Additionally, countries like Sweden, Finland, and Lithuania have specific alcohol-related laws and regulations. Breweries in Germany must comply with Reinheitsgebot, a beer purity law specifying approved beer ingredients. Moreover, craft beer is subject to significant taxes, with an EU-mandated excise duty of up to USD2.14 per 100 liters. Finland imposes the highest tax rate at USD0.69 per 330 ml bottle. These stringent regulations and high taxes are expected to impact the profitability and growth of the European craft beer market.

- The European craft beer market is thriving with an increasing demand for alcoholic craft beverages among young consumers, particularly millennials and Gen Z. Beer, a popular alcoholic beverage, is now offering health benefits through flavorful options like craft ale and innovative flavors such as CBD infused beers. Brewpubs are leading the craft production, utilizing advanced brewing technologies and distillation techniques to create premium products. However, challenges persist. Alcohol consumption and hectic lifestyles raise concerns about alcohol tolerance. Counterfeit products pose a threat in off trade channels like convenience stores and retail shops. To cater to diverse tastes, breweries are experimenting with organic flavors and varied tastes. E-commerce and social gatherings are driving sales in on-trade channels. Large beer companies are responding with bottom fermenting and top fermented yeast to meet consumer demands. Despite these challenges, the European craft beer market continues to grow, offering a rich and varied landscape for alcoholic beverage enthusiasts.

Segment Overview

This craft beer market in Europe report extensively covers market segmentation by

- Distribution Channel

- 1.1 Off-trade

- 1.2 On-trade

- Product

- 2.1 IPA-based craft beer

- 2.2 Seasonal-based craft beer

- 2.3 Pale ale-based craft beer

- 2.4 Amber ale-based craft beer

- 2.5 Others

- Geography

- 3.1 Europe

1.1 Off-trade– The off-trade distribution channels, including individual retailers, supermarkets, hypermarkets, specialty stores, and online platforms, dominate the craft beer market in Europe. These channels offer consumers a wide range of craft beer varieties and convenience, as they have extended hours of operation and do not require the additional cost of seating. Major players in this segment include Tesco Plc (Tesco), Carrefour SA (Carrefour), and Target Brands. The increasing number of grocery stores selling alcoholic beverages and the rising internet penetration in Europe are driving the growth of off-trade distribution. In 2021, the relaxation of COVID-19 restrictions led to a gradual increase in demand for beer from the on-trade segment. The normalization of conditions from the pandemic is expected to further boost the growth of the craft beer market in Europe during the forecast period.

Research Analysis

The Craft Beer Market in Europe is experiencing a significant in popularity, driven by the rise of Microbreweries and Independent Breweries. Consumers are increasingly seeking out Flavorful options, including Craft Lager, Ale, Stouts, and innovative flavors like CBD infused beers. Health-conscious drinkers are also opting for Low Alcohol Beverages and No Alcohol Beers. Consumer Preferences are shifting towards organic and locally sourced ingredients, reflecting a growing awareness of the health benefits of natural ingredients. The Craft Beer Industry is embracing advanced Beer brewing technologies to meet these demands, offering a diverse range of options for Millennials and Gen Z. The market is segmented into On trade and Off trade channels, with Brewpubs playing a crucial role in the On trade sector. The Large Beer companies continue to dominate the market, but the Craft Beer Industry is gaining ground with its unique offerings and consumer-focused approach. Bottom fermenting and Top fermented yeast continue to be popular brewing methods, with Alcohol tolerance varying widely among consumers. Retail shops and online platforms are key distribution channels for Craft Beers, making them easily accessible to consumers.

Market Research Overview

The European craft beer market is experiencing a popularity, with microbreweries and independent breweries leading the charge. Consumer preferences for flavorful, high-quality alcoholic beverages continue to drive growth in the industry. Low alcohol beers and no alcohol options cater to health-conscious consumers, while innovative flavors such as CBD infused beers and varied tastes keep millennials and Gen Z engaged. Urbanization and social media have made craft beer more accessible than ever before, with brewpubs and craft production at the forefront. Beer quality is paramount, with brewers experimenting with new brewing technologies and distillation techniques. The craft beer consumption trend extends to popular drinks like craft lager, ale, stouts, and even light lager. Off trade channels, including convenience stores and retail shops, as well as on trade, such as bars and restaurants, are important outlets for these premium products. Despite the convenience of e-commerce, social gatherings remain a key part of the craft beer experience. However, the industry faces challenges such as counterfeit products and hectic lifestyles, requiring brewers to adapt and innovate to meet changing consumer demands.

Table of Contents:

1 Executive Summary

2 Market Landscape

3 Market Sizing

4 Historic Market Size

5 Five Forces Analysis

6 Market Segmentation

- Distribution Channel

- Off-trade

- On-trade

- Product

- IPA-based Craft Beer

- Seasonal-based Craft Beer

- Pale Ale-based Craft Beer

- Amber Ale-based Craft Beer

- Others

- Geography

- Europe

7 Customer Landscape

8 Geographic Landscape

9 Drivers, Challenges, and Trends

10 Company Landscape

11 Company Analysis

12 Appendix

Key insights into market evolution with AI-powered analysis. Explore trends, segmentation, and growth drivers- View the snapshot of this report.

SOURCE: PR Newswire / Technavio (Press Release)

PHOTO CREDIT: Technavio