Heineken® 0.0 research in collaboration with University of Oxford Professor Charles Spence reveals the acceptance of low and non-alcoholic beverages continues to rise, although social pressure and being questioned when choosing alcohol-free options persist.

At the start of the new year and Dry January, the outlook for the low and no alcohol category looks positive for 2025; although research from Heineken® shows there are still some hurdles to overcome.

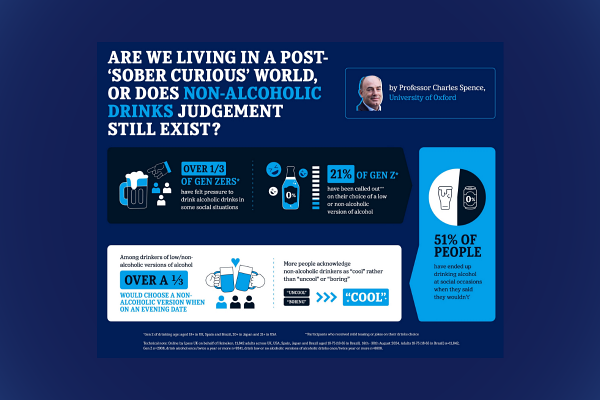

The global 0.0 beer market is currently worth US$13.7 Billion, and accounts for 1.7% of global beer volume. The HEINEKEN Company has driven growth in the 0.0 beer category with a 10% CAGR over the past five years, led by Heineken 0.0® reporting 14% growth in the first half of 2024. This performance surpasses what is one of the fastest growing beverage categories globally, which delivered a growth rate of 4.8% CAGR in the same five-year period, as consumer interest continues to build1. This is also underpinned by new study findings showing that 0.0 is seen as a confident choice as participants acknowledge non-alcoholic drinkers as “cool” (9%) and “respectable” (25%) rather than “uncool” (4%) or “boring” (6%).

Despite the growing opportunity and potential scale of the low and no alcohol category, new research into drinking habits from Heineken® 0.0 in collaboration with University of Oxford Professor Charles Spence has revealed that in some situations social pressure is still a barrier to choice and consumption.

An early leader in the low and no alcohol category, HEINEKEN has been investing and innovating since 2017 to fuel increasing demand for alcohol free alternatives, and the segment now accounts for over 4% of HEINEKEN’s portfolio, with notable growth in several key markets. In Europe, as well as in the United States and Brazil, Heineken® 0.0 and Sol 0.0 are gaining significant traction.

Charles Spence x Heineken 0.0 Anthropology Study Infographic

This new study undertaken by Charles Spence, Professor of Experimental Psychology at the University of Oxford and Heineken® 0.0, surveying 11,842 adults across five developed non-alcohol beer markets UK, USA, Spain, Japan (over the legal drinking age up to 75 years old), and Brazil (18 – 65 years old), found that despite the rising acceptance of low and non-alcoholic beverages, certain demographics report they feel societal pressure or are being questioned when choosing alcohol-free options.

Within the surveyed group, Gen-Z (legal drinking age to 26 years old) experiences the highest levels of societal expectations around alcohol consumption, with more than one in three reporting to have felt pressure to drink alcohol in some social situations.

Some other notable findings from the study tell us:

- 21% of Gen Z say they have concealed drinking low and no alcohol versions of alcoholic beverages because of social pressures.

- 38% of Gen Z men say they would be willing to drink low and no alcohol versions of alcoholic drinks, but only if their friends do too.

- If and when Gen Z men choose to drink a low or no alcohol version of alcoholic drinks, 29% feel they need to explain and justify their choice of drink and even feel like “outsiders” for doing so.

- When it comes to moderation, there is a gap in what people say versus what they do – 51% of people have ended up drinking alcohol when they said they wouldn’t, which could be due to social pressure.

HEINEKEN wants to tackle the stigmas around social acceptance of choosing low and no alcohol beverages with a clear message: if someone chooses dry, it doesn’t matter why. To empower people to be reason free, Heineken® launches its new campaign ‘0.0 Reasons Needed’ as part of the ongoing strategy to grow the category and refresh the market’s perspective on low and no-alcohol beverages.

“For generations, alcohol has played a central role in the way humans socialise, therefore dominant assumptions and stereotypes surrounding our drinking habits remain deeply ingrained in society. Our study has uncovered some fascinating insights into evolving societal attitudes towards alcohol consumption. For many, alcohol is no longer the default in social situations – we’re seeing a shift towards more mindful consumption, despite the stigma that younger generations of legal drinking age still experience.”

Charles Spence, Professor of Experimental Psychology at the University of Oxford

Heineken®’s latest campaign follows the ongoing efforts of Heineken® 0.0 to expand the NAB category, featuring impactful sponsorships like Heineken® 0.0 x F1 and its “When You Drive, Never Drink” message, as well as inspiring ambassador partnerships, such as the one with four-time world racing champion Max Verstappen. HEINEKEN continues to lead the way in driving cultural and behavioral change. Matching the rising demand for Heineken® 0.0, it is now available in 114 markets to date.

“As the global leader in the low and no alcohol beverage category for almost a decade, HEINEKEN is uniquely positioned to both predict and respond to consumer needs. Our research shows that the acceptability of 0.0 beer is at an all-time high. However, social stigmas still hinder our vision that everyone should always have a choice and should not be held back from choosing 0.0. Through campaigns like ‘Heineken® 0.0 Reasons Needed,’ we are committed to empowering responsible consumption and fostering a culture of moderation. Three years into our Brew a Better World 2030 strategy, our focus on consumer empowerment is stronger than ever. By offering 0.0 beer options, delivering excellent taste, and tackling social stigmas, we are redefining choice. Looking ahead to 2025, our ambition is to ensure that no-alcohol options are available for one strategic brand in key markets covering 90% of our business.”

Joanna Price, Chief Corporate Affairs Officer HEINEKEN

Technical Note

The research was carried out by Ipsos UK on behalf of Edelman and Heineken. Ipsos UK interviewed a representative quota sample of 11,842 adults using its online omnibus, including a boost sample of 1,483 Gen Zs. Fieldwork was carried out in five markets – UK, USA, Spain, Japan and Brazil.

The sample achieved is representative of the population aged 18-75 in all markets except Brazil, where the participants were aged 18-65. Quotas were set on Age within Gender, Region and Working status.

The data have been weighted to the known offline population proportions for interlocking cells of gender within age, working status, as well as region and education (in UK, USA, Spain, Brazil), social grade (UK only) and income (USA only) to reflect the adult population of this audience in each market.

Whilst there are some differences by market, figures cited here are based on an overall average, with each country having an equal weight.

Fieldwork was carried out between the 16th August and 30th August 2024.

Base sizes below:

Base | All markets | UK | Spain | USA | Japan | Brazil (18-65yrs) | All markets Gen Z (18-26 yrs) | All markets Gen Z (18-26 yrs) men |

All adults (18-75 – BR 18-65) | 11,842 | 2465 | 2355 | 2413 | 2376 | 2233 | 2908 | 1,397 |

All adults aged 18-75 (BR 16-65) who have had low or no alcohol drinks once/twice in last year or more | 9241 | 2059 | 2026 | 1756 | 1597 | 1803 | 2109 | 1028 |

-#-

SOURCE: Heineken (Press Release)

PHOTO CREDIT: Heineken